Family Fun Abounds in Plano, Texas

(NewsUSA) - Looking for a family getaway that’s anything but ordinary? Look no further than Plano, where Texas-sized fun comes without big-city hassles or price tags. Just 20 minutes from DFW airport, Plano offers the perfect mix of outdoor thrills, indoor fun, colorful festivals and tempting eats. Walkable lodging, entertainment and dining areas make it easy to strike the right balance between recreation and relaxation. Here’s a head start on planning your family adventure in Plano:

- Looking for a family getaway that’s anything but ordinary? Look no further than Plano, where Texas-sized fun comes without big-city hassles or price tags. Just 20 minutes from DFW airport, Plano offers the perfect mix of outdoor thrills, indoor fun, colorful festivals and tempting eats. Walkable lodging, entertainment and dining areas make it easy to strike the right balance between recreation and relaxation. Here’s a head start on planning your family adventure in Plano:

Get colorful at The Crayola Experience a wonderland of color and creativity with 22 hands-on attractions, letting kids of all ages name and wrap their very own Crayola crayon, see how crayons are made, star in their own coloring book and more.

Go Ape! Don’t just get out in nature -- glide over the forest canopy at Go Ape! Treetop Adventure Course. Zip lines, Tarzan swings and suspended obstacles bring out everyone’s inner monkey amid 800 acres of natural beauty.

Go back in time at Heritage Farmstead, a living history museum on a 360-acre farm that recreates Victorian-era life. For another fun, nostalgic activity, climb aboard a vintage train car at the Interurban Railway Museum in Plano’s quaint downtown arts district.

Get festive. If you happen to visit Plano in late September, enjoy the signature Plano Balloon Festival, with its magical evening balloon “glows,” tethered balloon rides, and carnival atmosphere. But there are other fun happenings all year round and no matter when you visit, you’re sure to come across a colorful festival, street fair or free outdoor concert.

Taste your way around Plano. Plano has more restaurants per capita than New York or San Francisco and offers up great renditions of kid-friendly favorites like burgers, pizza, Tex-Mex and more. For those nights when everyone in your family wants something different, there’s always Legacy Hall, a European-style food hall with individual stalls offering multiple choices, from duck fat- fried chicken and lobster rolls to Belgian-style waffles to gourmet s’mores featuring house made marshmallows, all under one roof. Parents can enjoy craft cocktails, wine or beer brewed on site along with their meal of choice.

Stay in style. Plano hotels have mastered the art of making kids feel at home and parents feel pampered after a busy day of play. Two convenient and popular options are the Dallas/Plano Marriott at Legacy Town Center and the Dallas/Plano Hilton Granite Park.

For further information or help planning a family adventure in Plano, go to visitplano.com.

-

-  “Tune in Tomorrow”

“Tune in Tomorrow”  “The Third Way”

“The Third Way” “Cobblestones, Conversations and Corks”

“Cobblestones, Conversations and Corks” ”

”

- Accidents happen: you hurt your shoulder fixing that broken gutter or throwing a baseball, develop carpal tunnel syndrome from your less-than-ergonomic work-from-home setup, or you suffer from painful tendon or joint conditions such as arthritis.

- Accidents happen: you hurt your shoulder fixing that broken gutter or throwing a baseball, develop carpal tunnel syndrome from your less-than-ergonomic work-from-home setup, or you suffer from painful tendon or joint conditions such as arthritis.

- The scorching sun is the major reason that skin cancer is the nation’s

- The scorching sun is the major reason that skin cancer is the nation’s

- Maaco, the iconic American body shop, is celebrating 50 years of affordable auto body paint and repair with a Labor Day giveaway -- 50 pairs of gold Ray Ban sunglasses.

- Maaco, the iconic American body shop, is celebrating 50 years of affordable auto body paint and repair with a Labor Day giveaway -- 50 pairs of gold Ray Ban sunglasses. -

-  “Waves of Hope”

“Waves of Hope” “The Winning Playbook”

“The Winning Playbook” “Bit Flip”

“Bit Flip” “There Will Be Lobster”

“There Will Be Lobster”

- Summer is here, and the job market for teens is hot. More travel and activities this summer are driving the need for teen workers to fill jobs as lifeguards, house sitters, dog walkers, restaurant workers and retail employees.

- Summer is here, and the job market for teens is hot. More travel and activities this summer are driving the need for teen workers to fill jobs as lifeguards, house sitters, dog walkers, restaurant workers and retail employees.  - Celebrated novelist Mike Bond’s ambitious “America” series relives the last 70 years and our nation’s most profound upheavals since the Civil War. Now, through the wild, joyous, heartbroken and visionary lives of four young people, the story continues in book three, entitled “REVOLUTION.”

- Celebrated novelist Mike Bond’s ambitious “America” series relives the last 70 years and our nation’s most profound upheavals since the Civil War. Now, through the wild, joyous, heartbroken and visionary lives of four young people, the story continues in book three, entitled “REVOLUTION.” The book follows the first two volumes in the series -- “America” and “Freedom.”

The book follows the first two volumes in the series -- “America” and “Freedom.”  Midwest Book Review calls “REVOLUTION” “an extraordinary and deftly crafted novel that combines interesting characters within the context of a historically detailed background … an inherently entertaining … fascinating read.”

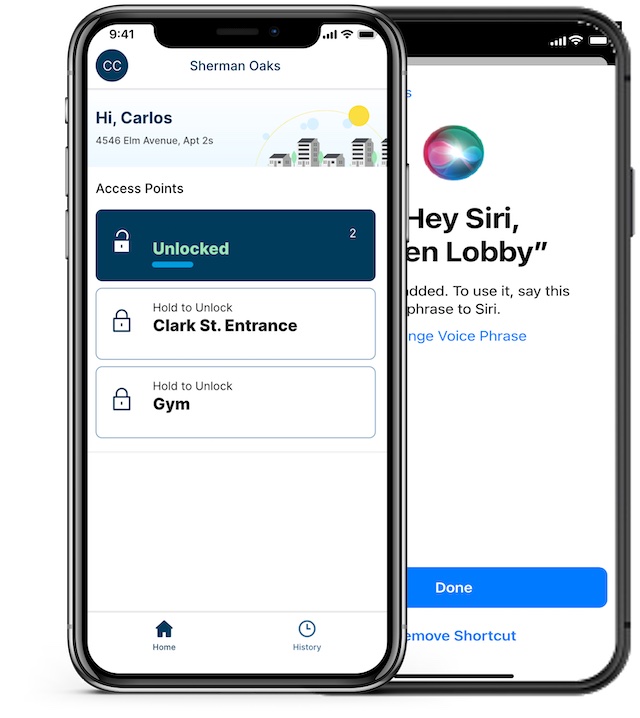

Midwest Book Review calls “REVOLUTION” “an extraordinary and deftly crafted novel that combines interesting characters within the context of a historically detailed background … an inherently entertaining … fascinating read.”  - Today’s Millennial and Gen Z apartment hunters are tech-savvy, smart and safety-conscious. That means they are seeking the best in high-tech features that make their lives easier, safer and more fun, and they are willing to pay more for it. Parks Associates’ research on multifamily property owners shows that a third of residents are willing to pay an additional 15% per month in rent for smart amenities.

- Today’s Millennial and Gen Z apartment hunters are tech-savvy, smart and safety-conscious. That means they are seeking the best in high-tech features that make their lives easier, safer and more fun, and they are willing to pay more for it. Parks Associates’ research on multifamily property owners shows that a third of residents are willing to pay an additional 15% per month in rent for smart amenities.

-

-